While Wall Street looks the other way, a select group of IPO stocks are soaring higher! This could be the biggest opportunity of the decade... one you don't want to miss!

Our Proven IPO Investing Strategy is on FIRE...

With Our Total Portfolio UP +75% Year-to-Date

Fellow Investor,

Despite a rocky start to 2023, a group of select stocks have been performing well in this same environment…

Stocks that I’ve been advising my readers to load up on immediately.

These stocks can make smart investors super rich if they know what to buy, but more importantly, when to buy.

This strategy isn’t new to me. It’s been put it to the test repeatedly over the years.

In fact, the last time I started loading up on stocks following this system was June 2022.

As the broader market slid into bear territory, I started seeing the first signs of life in these early-stage companies.

As it turns out, companies that the underwriters are confident enough to push out in a slowdown have strong odds of outperforming the market on average.

Why? Because when times get tough, these hungry little companies are faced with two choices: majorly disrupt their industries in some way to survive or die trying.

The recession-tested IPOs that survive tend to be leaner, meaner and more motivated… making it a sweet spot for investors as we are experiencing right now!

Here’s a quick look at our open Buy List at this very moment:

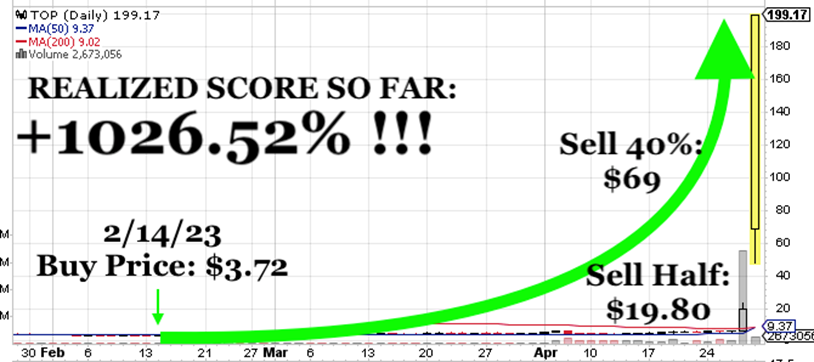

- +1,026.52% in TOP Financial Group Limited (TOP). We had a bumpy start to this one, but my research showed there was more to the story. Wall Street had written this little company off for dead, but it still had huge potential. We double down on 2/14/2023 and got the accelerated recovery I saw coming. We locked in some profits yesterday, but I’m scoring TOP at +1,026.52%… so far!

- +304.33% in my January 2023 pick. This stock popped +107.96% in February 2023, so we sold half to lock in our profits. Once again, my research indicated more upside, so our remaining position continues to run higher.

- +104.21% in my July 2022 pick. This one still has some wind beneath its wings and is soaring higher.

- +57.54% in my June 2021 pick. This is the oldest position in my Buy List currently, but the story hasn’t fully developed yet. We’re holding for the big pop!

- +45.05% in my November 2022 pick. This is one of my favorite stocks right now. It’s not to late to get in, but you’ll want to act quickly if you don’t want to miss the run higher.

- +1,026.52% in TOP Financial Group Limited (TOP). We had a bumpy start to this one, but my research showed there was more to the story. Wall Street had written this little company off for dead, but it still had huge potential. We double down on 2/14/2023 and got the accelerated recovery I saw coming. We locked in some profits yesterday, but I’m scoring TOP at +1,026.52%… so far!

All this to say, there is money to be made in this market, you just have to know where to look

Look Beyond the Smokescreen...

Some Lucrative Opportunities Await

All we need is the right combination of quality deals and investor frustration with established stocks to bring this area of Wall Street back to life. Fast-growing companies are still growing.

Sometimes they’re growing even faster than they were before the recession threat as wounded rivals capitulate. Either way, they’re expanding faster than the economy or the market as a whole… which is all it takes.

I need you to hear me when I say, “No recession lasts forever. Investors who can look beyond the week’s headlines will be prepared for the boom ahead.”

Now, not every IPO is going to be successful. Some of the underwriters are still a little hungover from the Fed’s zero-rate party. But we’re seeing enough quality that the numbers look extremely good for 2023 and beyond.

Let me tell you about two of my recent favorites…

TOP Financial Group Limited (TOP)

I liked this stock as a short-term tactical play to help us make some quick cash.

TOP is something like the Robinhood (HOOD) of Hong Kong, and while it did test my nerves, it did finally play out as I had anticipated.

We bought our initial shares of TOP in July 2022. We then doubled down and bought again in February 2023. Within 10 weeks, TOP skyrocketed giving us a quick +1,026.52% profit!

We’re still holding on to a few shares just to see how far this stock can run…

Now, let me tell you about my other favorite stock… Atlas Lithium Corporation (ATLX), which I like for entirely different reasons.

You’ve already heard how crucial expanding the lithium supply is as the EV revolution unfolds. ATLX isn’t necessarily the magic bullet, but it’s the newest lithium play on Wall Street.

Before January 2023, it was an obscure foreign stock traded OTC. We pounced when it graduated to the NASDAQ and got in at $8.54. A few weeks later, word had spread and we had a quick +107.96% gain in a matter of 4 WEEKS!

This is not a fluke. We’ve hit triple-digit scores before. This is how the IPO market works. But you need to get in early… and you need to keep your eyes open.

This is how I have personally recovered lost ground to the bear, and how I’m getting back to work while the rest of the market is still dazed and confused.

It’s been a rough couple of years in the market and the dust hasn’t settled yet. However, investors who are able to look beyond the recession and the latest media headlines are already realizing the benefits.

If you’re ready to get a front-row seat to lucrative world of IPO investing, you must get on board right away.

Because here’s the unfortunate truth…

99% Of Investors Miss This

Once-In-A-Decade Phenomenon

They make the biggest mistake and cash out during bear markets.

But not the smart investors. Top investors throughout history know this is the time to invest.

People like Nathan Rothschild who said, “The time to buy is when there’s blood in the streets.”

Or John Templeton who said, “To get a bargain price, you’ve got to look for where the public is most frightened and pessimistic.”

Or Warren Buffett who’s said, “The best chance to deploy capital is when things are going down.”

Personally, I’ve known this for over three decades now.

In fact, my team has been eagerly waiting to capitalize on this these select stocks since the last crash.

While everyone in Wall Street is panicking and freaking out, my team and I are picking up these select stocks like nobody’s business.

After all, I’ve used this strategy to skyrocket my own net worth at least 4 times.

The first time I did it, I made enough to ensure that I never had to work another day in my life.

In the 2001 recession, for example, I invested in Accenture when it was going public, and I made a healthy 77% by the end of that year… not bad when the Nasdaq dropped 9% that same year… but the real win has compounded over time. That stock is up 1,676% as I write this. A $1,000 investment in the stock back in 2001 has turned into $18,000 today.

But before I say more about how you can profit from these select stocks we’ll discuss today, let me tell you a little bit about myself first.

How I’m Going To Help You Profit

Like Crazy During This Bear Market

My name is Hilary Kramer.

I've been investing in markets for over three decades and made a lot of people very rich.

Now, I can spend hours telling you about my home runs and how I discovered stocks after winning stocks using my deep connections from Wall Street...

... but instead, I'm going to just share my secret with you.

You see…

There’s a reason I have an “unfair advantage” over all the other portfolio analysts out there in the IPO game.

It’s not a fancy CFA, CMT, or even a LIFA title.

It’s not having the best technical indicators or even a world-class research team.

It’s that when I got started on Wall Street…

My full-time job was all about bringing companies public.

I’ve been a Wall Street insider working behind-the-scenes to price and launch companies for their first day of trading.

Some of the companies I’ve listed may be familiar to you. I’ve worked on heavyweights like Adobe… Oracle… Starbucks… Fisher Scientific… Lattice Semiconductor…. AstraZeneca PLC… even Coca-Cola Enterprises back in the day.

These are companies that are now worth billions!

This gave me a real edge over other investors. I can price a company more accurately and spot winners BEFORE they even list on the stock exchange.

It's Time to Turn Off the News and Get Rich...

In other words, we’ve got money to make.

And this is the best time to get richer than any other.

Here’s what’s really going down.

The market is now behaving irrationally.

The average IQ of every market trader just dropped 90% from all their fear and panic.

Even the most experienced fund managers are doing ridiculous things like flushing stable blue-chip companies in a firesale.

In short – almost everyone except the smart investors are making HUGE MISTAKES… mistakes you can take advantage of and get rich!

So tune out the news, the masses, the doomsayers. They are all running the WRONG direction.

We want to be going IN to scoop out the crown jewels when everyone else is running the other way.

And what kind of gains am I talking about? Just take a look at some of the past recommendations I’ve made in the past…

- Proofpoint (PFPT)… +10,157% return

- Repligen (RGEN)… +3,729% return

- Advanced Micro Devices (AMD)… +2,446% return

The list goes on and on… and on.

And every time disaster strikes, there’s boatloads of money to be made.

So now’s the time to get into the markets and take what’s ours.

This is how we’re going to do it.

Why Hilary is Called “The IPO Insider”

Hilary Kramer is a Certified Fraud Examiner (CFE) and an MBA alumni from Wharton Business School. She’s currently the Chief Investment Officer for Kramer Capital Fund. She’s also the founder and CEO of Greentech Research, the first green hedge fund ever to be set up in America.

Hilary has appeared as an expert contributor on the Nightly Business Report on PBS, The Wall Street Journal, Fox News Channel, ABC, Bloomberg, and CNBC, among others.

She’s the author of three books, “Ahead of the Curve”, “The Little Book of Big Profits from Small Stocks”, and the recent Wall Street Journal, USA Today, Amazon #1 bestseller – “GameChanger Investing”.

She’s also the winner of the 2021 Gracie Award for her nationally syndicated radio show “Kramer’s Millionaire Maker” on the Salem Radio Network.

“Be Fearful When Others Are Greedy,

And Greedy When Others Are Fearful.”

~ Warren Buffett

Let me ask you, as companies like Apple… Coca-Cola… Intel… and NVidia ever going to go bust just because the economy got a bit tough?

Of course not.

This isn’t rocket science.

Most people already know this and are hoarding on to blue chip stocks. This works great if you’re happy picking up fallen poker chips on the floor when someone screams “fire” in a casino.

But for those who know what to look for, you can score a much larger profit… in less time… and take on less risk for it.

We don’t chase after the loose change.

We go in for the crown jewels.

Now I’ve been a successful investor longer than the last four recessions.

And right now, the market is acting like we’ve got a golden window of opportunity.

You see… there is a certain type of stock that Wall Street ignores during downturns.

And our data shows that these companies bought during a recession routinely OUTPERFORMS the market every time.

This is the untold method to amass great fortunes during market turmoil!

In fact, Warren Buffett… George Soros… Carl Icahn and all the investors who are billionaires today are all applying variations of this process one way or another.

How to Build Massive Wealth in a Volatile Market

It’s simple:

We target companies that are getting listed during a recession.

Now, you might be saying…

Buying a new publicly listed company during the worst recession of our time is bad timing, right?

Wrong!

That’s what the market thinks. I don’t blame them… it’s easy for seasoned Wall Street analysts to fall into this trap. But not a Wall Street IPO insider like me.

The truth is, getting listed on the stock exchange when the economy is going through hell is the ultimate stress test for a company to prove their real worth.

It’s basically a grueling “Hell-Week” for companies. Only the toughest get through “Hell-Week.”

Let me pull back the curtain for you… a company’s management team needs absolute clarity and conviction when they decide to go public during an economic meltdown.

And the investment bankers need clarity too if they want to keep their comfy careers for long in a recession. The bar isn’t extremely high (14% in the first 6 months), but the penalties for failure are severe.

They must succeed because they only get one shot at ringing the debut bell on Wall Street.

You’ll quickly know which are the tough-as-nails market leader companies from the wannabes.

In fact, the investment banks who underwrite the companies’ stocks are under greater regulatory scrutiny too. That’s a good thing for us!

They can’t just package any corporate trash under a new ticker symbol when investors are showing little appetite for shares.

In collapsing markets, there’s almost zero tolerance for froth, hype, and empty-promises.

If they hope to raise any money at all during an Initial Public Offering (IPO), they’d have to shelf the dodgy deals and showcase only rock-solid quality companies.

Which companies do you think those investment banks would pick?

Exactly. The one who passed “Hell-Week.”

This separates the long-term darlings from the duds real quick.

Why Stock IPOs Make

The Most Money During Down Turns

Here’s proof…

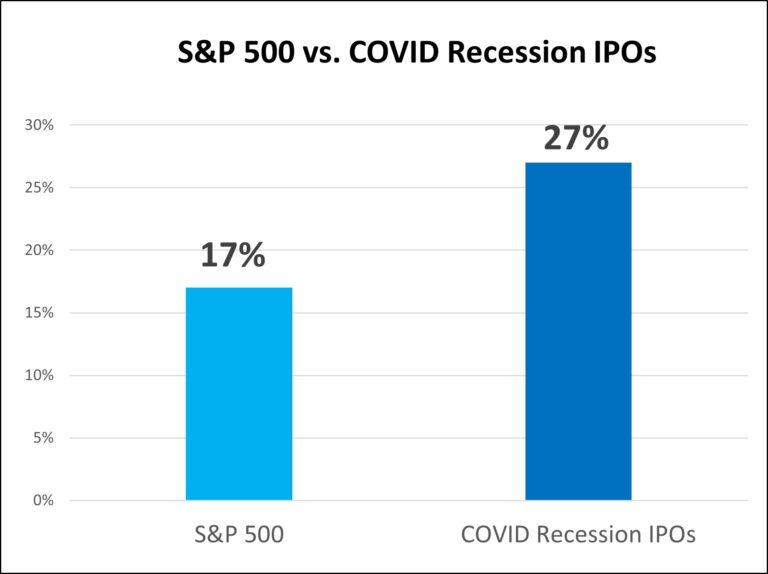

If you had bought every IPO in the COVID recession of 2020, you’d have a 27% gain advantage even during the grip of the current bear market. The S&P 500 is hanging onto a much slimmer 17% gain.

That means, you boosted your return 10% above what the “safe, mature, defensive” S&P 500 index funds provided just by collecting every IPO stock!

We even found a way to buy IPO stocks without committing to a minimum fee.

Already you’re doing much better than blue chip companies like Apple… Coca-Cola… Intel… and Nvidia.

It’s not just a flash in a pan either. Recession-era listed companies OUTPERFORM and OUTLAST all their competitors in their market sector.

When companies are forced to survive in the middle of an economic warzone, they dig deep into their arsenal and find ways to win because they had to. Anything less than a full-out-fight and they’d all go bankrupt by noon.

That’s why they outperform even the largest, more well-funded competitors in their space. Recession-borned survivors are as tough as nails. And as our data shows, it’s enough evidence that Wall Street needs to indicate long-term quality and success.

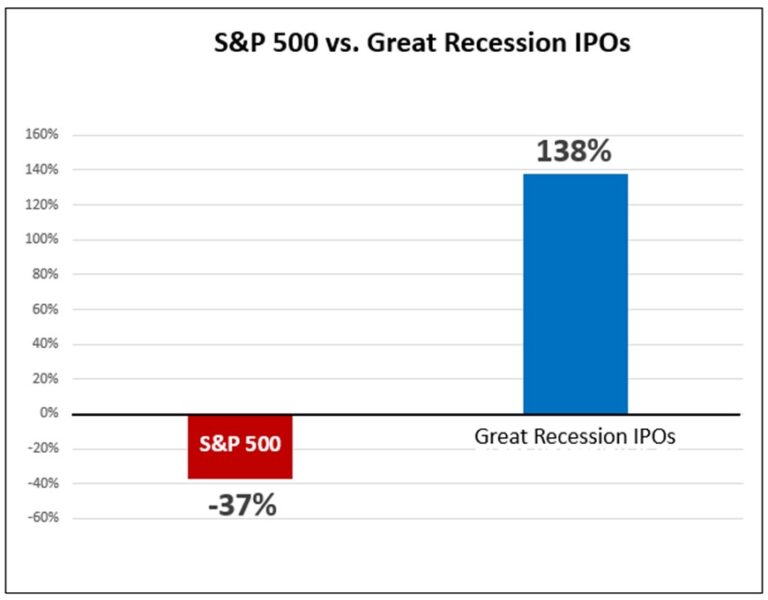

Here’s more proof. Let’s look at the Great Recession of 2008.

In the Great Recession, the S&P 500 plunged from a then-lofty 1,472 down to 923… losing 37% of its value.

However, companies that had what it took to go public in that environment and survive into the present GAINED 138% by the time the government declared that the recession was over.

In fact, the stocks that went public during the Great Recession are now up a net 373% today! The S&P 500 hasn’t done bad, gaining back all lost ground and an extra 154% as of today. But if you could only pick one ride, which one would it be?

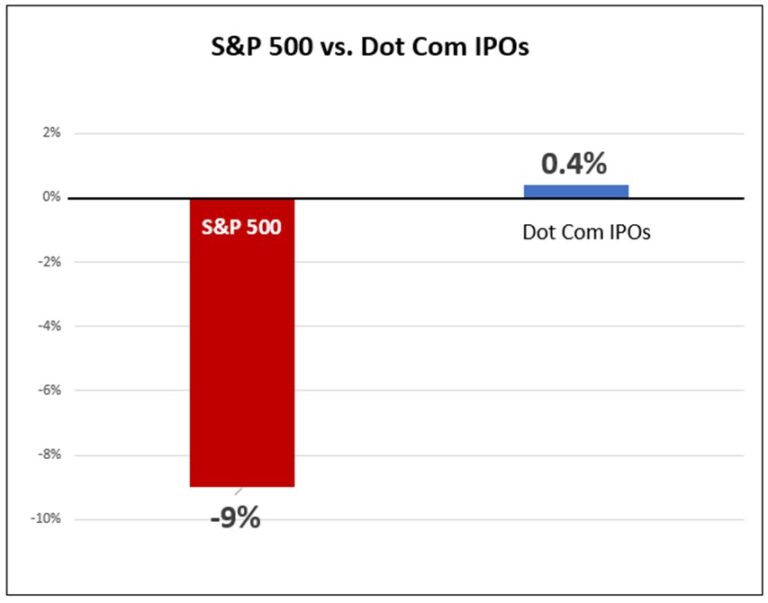

Let’s go further than that. Here’s data from the Dot Com Bust in 2001.

Stocks that went public in the wake of the 2001 recession have soared a healthy 877% from their starting day. Not every one has been a winner in the last two decades, but this was the era that gave Wall Street names like Advance Auto Parts (AAP, up a giddy 1032%) and Axon (AXON, up 22701%) and Hilary’s favorite Accenture (ACN, up only 1576%).

It was a savage bear market. These stocks collectively ended the recession a little ahead of breakeven (+0.4% for the group) because quite a few of them needed a little more time to get their bearings and chart a course through the storm. But the S&P 500 lost 9% over the same period.

Since then, the S&P 500 has done okay. It’s doubled from the start of the post-dot-com recession… but the stocks that went public during that recessionary era have doubled and doubled and DOUBLED that return.

All this to say, there are more undervalued opportunities in the IPO market compared to blue-chip stocks during a recession.

If you add up all the stocks that went public in the 2001 recession to current today, they’re now up 877% on average since their opening day.

In fact, we can go back 40 years in time… and what we see with each crash of that decade, is a time when new millionaires were minted.

And what’s more…

Today’s Recession-Era IPOs Are

Tomorrow’s Highly Defensive Value Stocks

There’s more evidence from where that came from. I can give you pages and pages of documented proof. Here’s a list of Recession-era IPOs of famous companies that are well known household names.

- 1980: When the economy was lurching into recession, a weird little company in Cupertino got listed on Wall Street. Seven months later, the economic downturn became official. This company held on to its IPO price of $22 per share by the fingernails. Since then, the stock had split a total of 224-to-1… multiplied its dividends and buybacks… and weathered through its heydays and their heartaches. Apple is now a $2 trillion titan. That’s a gain of 67,564%.

- 1981: A tiny retail chain had the fortitude to go public in the earliest stages of the economic downturn in September 1981. Home Depot is now a $305 billion company. That’s a gain of 1,153,940%.

- 1990-91: Companies like Aaon, Diageo and NorthRim Bancorp that made their debut on Wall Street during this recession might not be glamorous, but they continue to grow more than 30 years later. That limited bucket of recession-era IPOs have earned 13.9% compounded annually over their lifetimes.

- 2001: Advance Auto Parts… Accenture… Axon… and Bunge got listed in the middle Dot Com Bust. They are worth $55.87 billion today on average representing 1,659% in gains.

- 2008: Visa went public at $44 in 2008, right when the world felt like it was lurching over a cliff. It’s split 4-for-1 and paid $8.50 in dividends since. That’s 1,073% in gains.

- 2020: Right in the middle of a global pandemic, companies like Docebo Inc…Arconic Corp…Beam Therapeutics Inc. made their gutsy debut in the stock exchange. Collectively, they are worth $2.55 billion today on average representing 468% in gains.

You get it, right?

Most investors dump all their bets at the first hint of economic chill in the air.

They obsess over how bad the world looks and forget how good the future can become tomorrow.

That means we both have a head start!

We’re not just buying the oldest, most reliable, defensive and “mature” stocks on the market. We’re buying up stocks that are destined to be the defensive stocks of tomorrow.

For example…

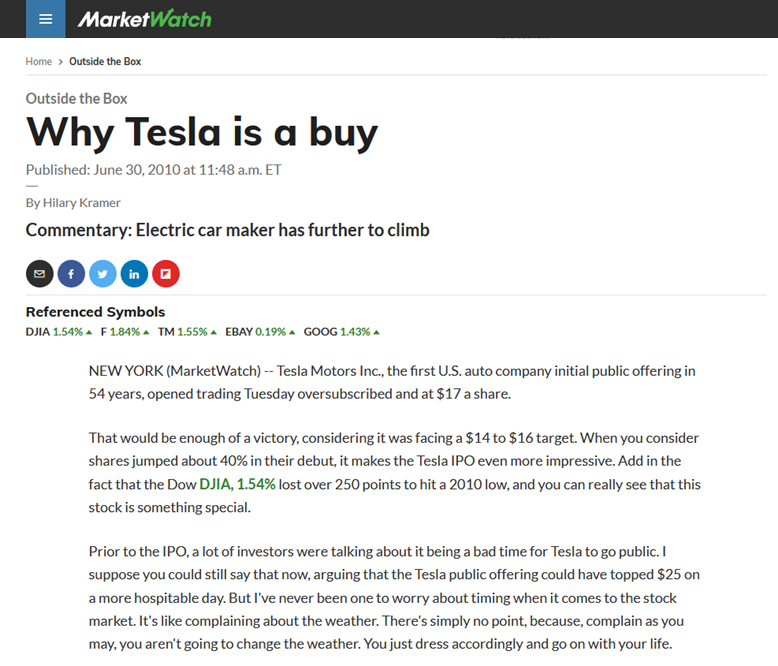

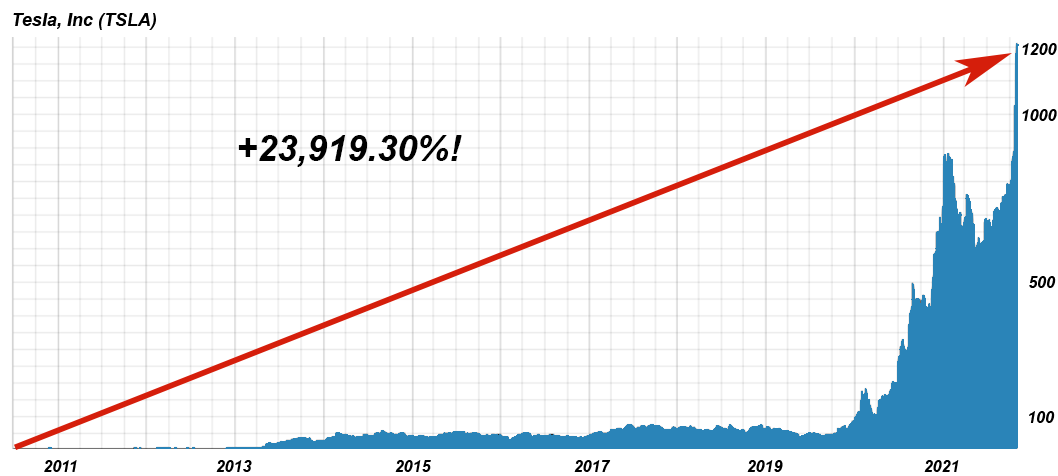

I recommended Tesla (TSLA) for $17 back in June 2010.

Tesla is all over the news these days.

But back in 2010, Tesla was bleeding cash.

The cynics pointed at Tesla’s small scale of production.

They even scoffed at Elon’s lack of automotive manufacturing expertise.

But Tesla was years ahead of its time.

My instincts told me that not only would Tesla survive… it would change the entire automotive landscape.

I went on record to say that investors can “expect hefty returns in the months ahead no matter what antics we see from the broader market.”

We were early… way earlier than other investors in spotting this opportunity.

In fact, we went in on the second day of Tesla’s IPO.

And it paid off.

But don’t just take my word for it… a reader who saw our recommendation made big money with Tesla.

Ennis B. from New Jersey bought Tesla at $5.00 and cashed out after it went up +9,355%!

That’s turning every $1,000 invested into $93,550! Or $10,000 into almost a million dollars!

My Tesla stock went up +9,355%!

I am Ennis and I have lived in New Jersey all my life and my best investment was trusting Hilary! I trusted her with TESLA when everyone was saying it was a waste of money. I bought my Tesla stock in 2012 at $5.00 and now it is up +9,355% and I own two TESLAS.

– Ennis B., New Jersey

Here’s another one…

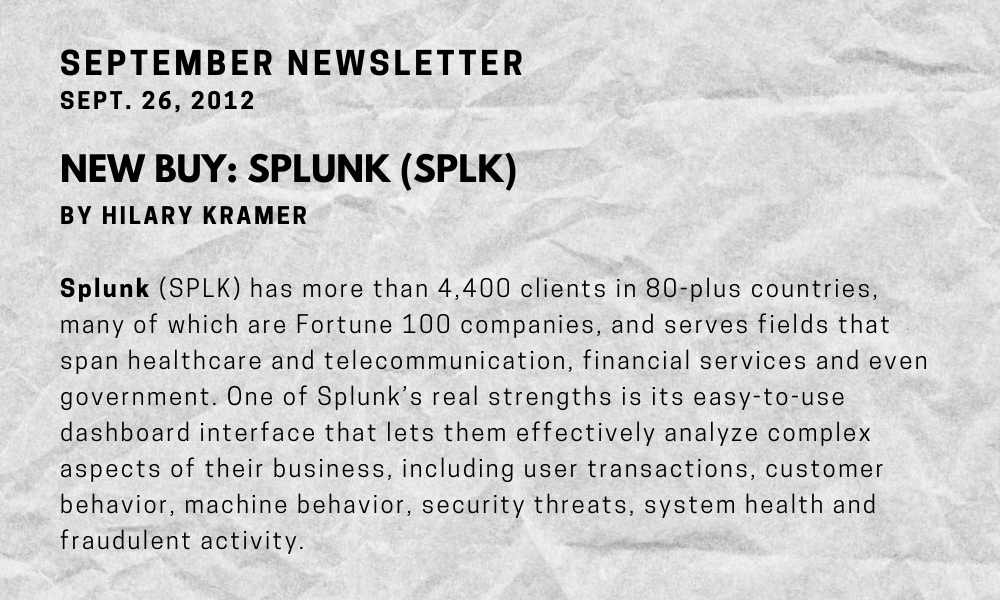

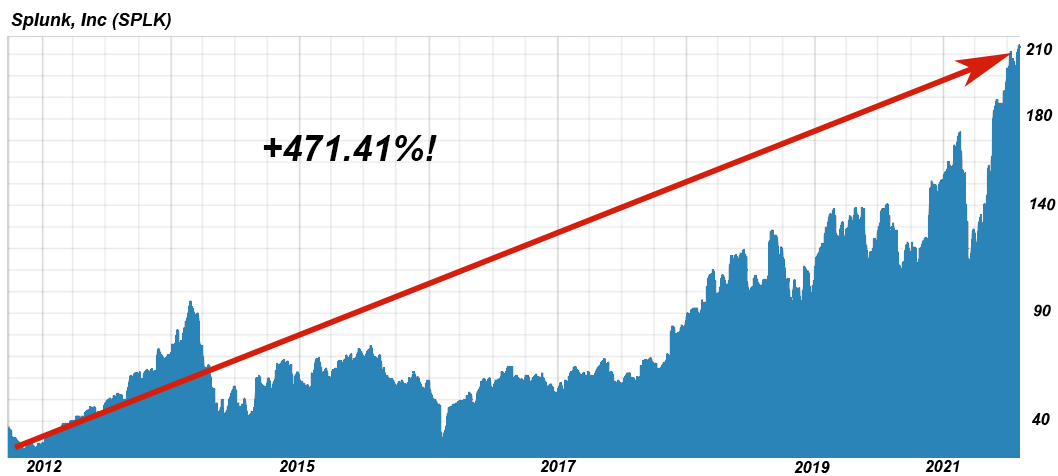

In 2012, I said that Splunk was on track for tremendous growth in the Big Data space.

At the time, the company was still in the red.

But for good reasons.

It invested heavily in marketing and R&D to drive growth at a later stage.

I recognized Splunk’s true growth potential, and its full earning power was right up ahead.

I recommended my readers buy Splunk (SPLK) below $38.50.

Why Wall Street Pays Attention to Hilary

“Hilary Kramer is a market geek! And I mean it in a very good way. Since I’ve known her, she’s on top of the trends and fresh ideas investors need to know!”

“–Gerri Willis, anchor and personal finance reporter, Fox News Channel.

“As we enter this new decade, Hilary Kramer shows investors how to spot and profit from the mega-trends for 2020 and beyond. Each chapter illuminates how tomorrow’s future trends need to be understood and applied to investing today.”

“–Susie Gharib, Anchor and Senior Special Correspondent, Fortune, and former co-host of CNBC’s Nightly Business Report

“Hilary Kramer has championed the underdog investor for her lengthy and successful Wall Street career as an investment guru and author. Kramer reveals where industry, robotics, science, and technology are heading and how the everyday investor can use this knowledge to create real wealth. Always entertaining and insightfully brilliant, Kramer can be counted on to cut through the mysteries of investing. The pros aren’t going to like you knowing what Hilary is going to tell you.”

“–John Crudele, syndicated columnist and business journalist, The New York Post.

“Who wants to be a millionaire? Step one: read Hilary Kramer’s blockbuster on Million Dollar Investing. There is no more reliable and trusted voice for financial common sense in America than Hilary and this book lays out the formula in simple, plain English.”

“–Stephen Moore senior economic advisor to Donald Trump, co-author of Trumponomics, and former Wall Street Journal economics writer.

“Kramer has produced a thorough investigation of breakthroughs about to emerge in the world of computing, communications, consumption, and health care.”

“–Jon D Markman, Forbes columnist and author of “Fast Forward Investing: How to Profit from AI, Driverless Vehicles, Gene Editing, Robotics, and Other Technologies Reshaping Our Lives.”

“What will determine your success as an investor in coming years? Hilary Kramer, Wall Street’s one-woman research powerhouse, says it’s the ability to identify and invest in winning trends. Her new book (Kramer)… peels back the research and insights that the smart money is using to figure out where the world is heading, and how to get out in front of it to position for monster profits in the next decade. Kramer does this by giving us captivating and compelling revelations of the remarkable and radical transformations that will come with advances in artificial intelligence, bionics for longevity, mobility, geospatial data, blockchain technology… and how investors must understand these innovations and disruptors in order to truly build wealth.”

“–Mark Stuart Gill, Contributing Writer, Bottom Line Personal.

“With an eye for telling clues worthy of a Sherlock Holmes, Hilary Kramer provides a timely guide to fathoming future trends!”

–Steve Forbes, Chairman and Editor-in-Chief of Forbes Media

“Hilary Kramer is legendary for being ahead of the curve amongst investment professionals. Kramer identifies tomorrow’s biggest trends and turns her prescient abilities into big profits for those that follow her wisdom. She is a one-person investment powerhouse.”

–John Dizard, Financial Times columnist.

“Hilary Kramer’s encyclopedic knowledge of individual stocks is exceeded only by her enthusiasm for sharing her ideas with average investors.”

–Randall Forsyth, Editor-in-Chief, Barrons.com

“If you haven’t heard of digital bullion… echo moms… cold chain logistics… aquatic superfoods… MindWars, you will! Kramer’s talent is making these opportunities understandable and actionable for the everyday investor in a way that gives you the same long-term advantages as the professionals.”

–Joe Piscopo, actor, comedian, and Radio Talk Show Host, The Joe Piscopo Morning Show on The Salem Radio Network, AM970 The Answer

Again, it paid off big time.

Take a look.

If you had invested $1,000 at the time, you would have made back $4,714 in return.

Want another example?

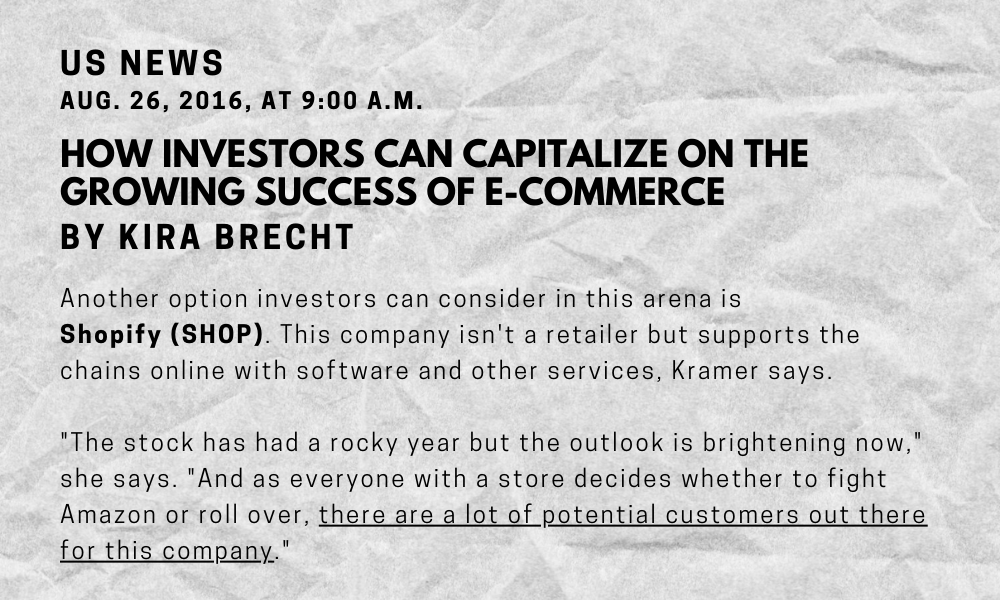

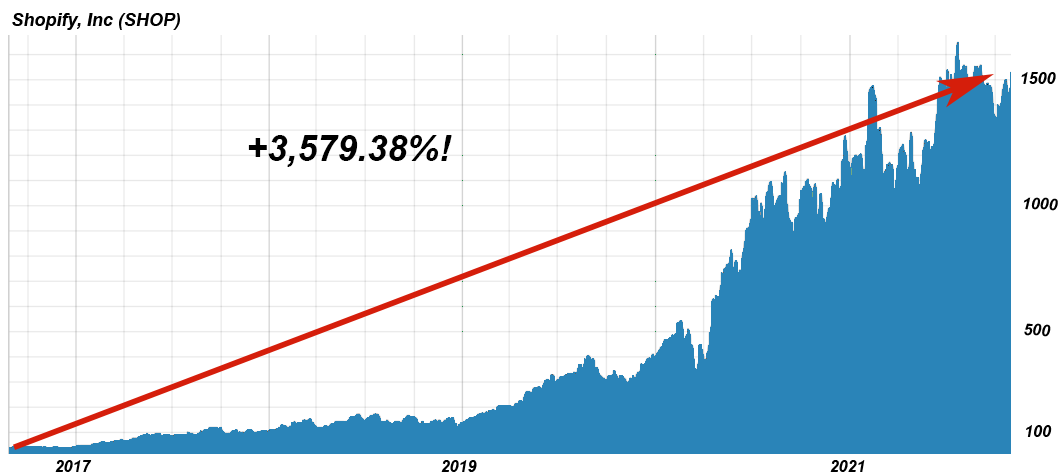

In 2016, I hinted in a public interview with US News that Shopify was going to give Amazon a run for its money.

Back then, Amazon was the 600-pound gorilla and Shopify suffered a rocky history.

It wasn’t even making money at the time.

But Shopify had a lot of potential.

It wasn’t competing directly with Amazon in retail, but provided all the software and services for small retailers to compete with Amazon.

That was the key to Amazon’s downfall.

Amazon was closing down its Webstore platform for small-to-medium businesses, leaving a void in the market for Shopify to flourish.

Not only was Shopify a better platform built for e-commerce, it was also cheaper than Amazon’s.

All the businesses that had outgrown Craiglist and eBay now had a Shopify platform to scale.

Shopify was on a trajectory to power more than 150,000 businesses worldwide.

Guess what happened after that?

The pandemic.

Shopify rode that e-commerce wave high up the charts.

These are just a few examples from a long list of early wins.

Readers have reported back with spectacular results.

In short, the IPO market contains some of the best wealth-building opportunities during market environments like the one we’re in right now.

Right now, I’m watching several IPOs that are ready to capitalize on this chaos.

So the question is… how do you select the right companies for your IPO portfolio?

Here’s How I’ll Help You Find

The Best IPOs

on Wall Street Today…

Here’s what you need to do now:

I have a small exclusive club named IPO Edge… where I share my latest IPO research with a private group of investors.

I started this club back in 2019.

Members with beta access have already gotten returns like…

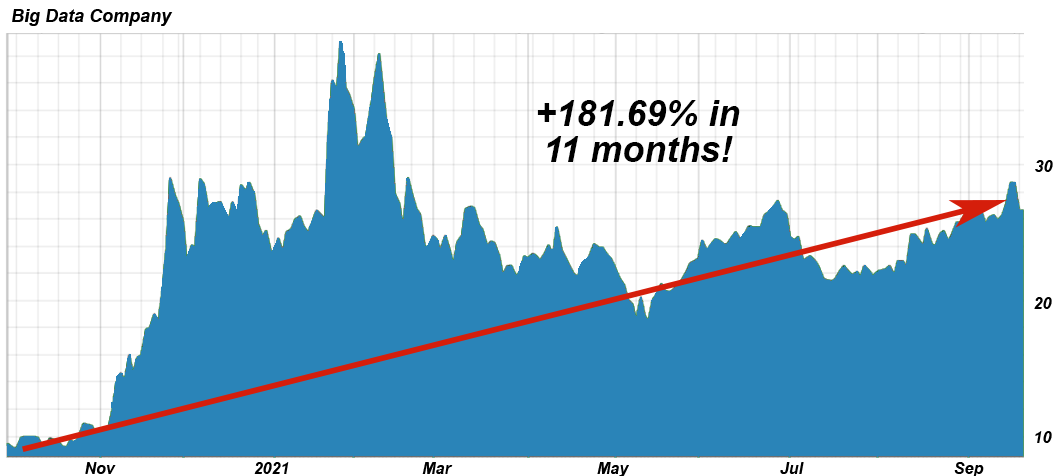

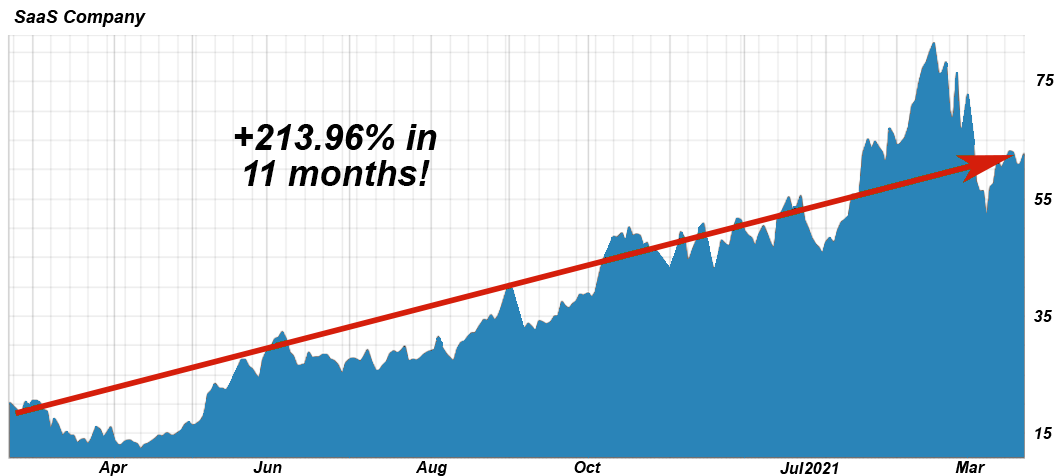

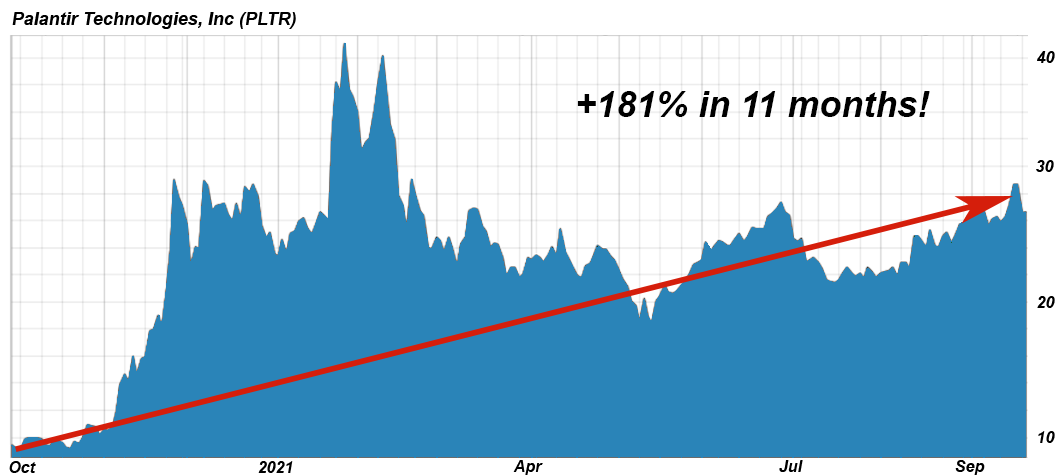

+181.69% in Big Data company…

… and that’s just in the early innings of these companies.

I have every reason to believe these gains will continue to grow… like my previous IPO wins.

And I want to tell you exactly which companies these are.

That’s why…

For the next 72 HOURS ONLY, I’m opening the doors again to IPO Edge…

Know When To Be Greedy

When Others Are Late

When it comes to IPOs, there’s a real hold up in the entire process.

Even investment banks like Goldman Sachs, JPMorgan Chase, Morgan Stanley or Citigroup have to wait HALF A YEAR before they can bring a company public.

But here’s where IPO Edge is different.

We take a different approach altogether.

When it comes to IPOs, we invest in early-stage companies IN REAL-TIME.

Let me repeat that, because it’s important. My private club, IPO Edge, invests in this unique way. Few people know how to do it…

We invest in early-stage companies IN REAL-TIME.

But what does that mean? It means…

- There are no lock-up periods

- You don’t need to be accredited or be a millionaire

- In fact, you get to invest in companies that anyone can afford

But how, you ask?

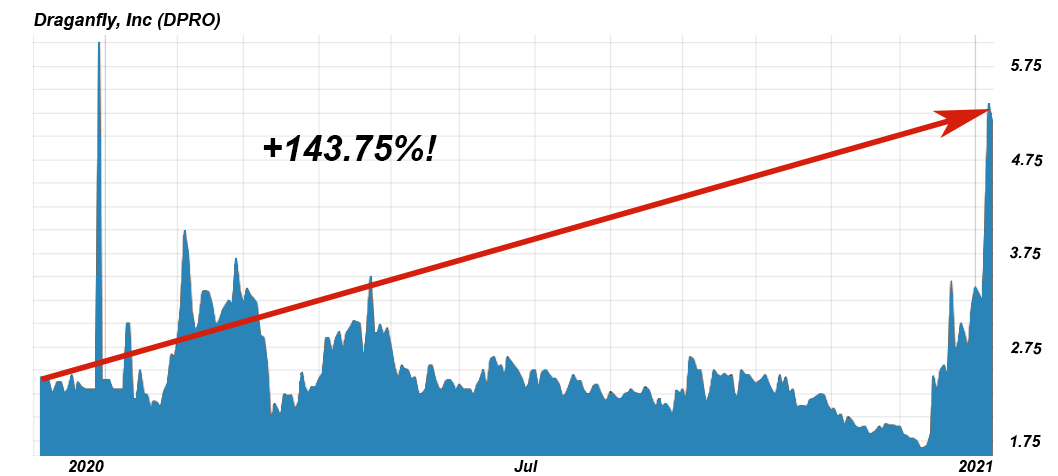

Let me explain with an example like Draganfly (DPRO).

I discovered this US-based, Canadian drone company back in June 2019.

Their innovative drones are used by police departments to track missing people and firefighters to assess fire damage.

When COVID-19 hit, they quickly adjusted their technology to detect people with fevers at universities.

Most importantly, Draganfly has long-term military contracts to supply drones for reconnaissance.

My research team spotted this opportunity early and began our detailed analysis to determine the best time to buy.

Draganfly traded on the Nasdaq on Nov 5, 2019, but we waited until Nov 12, 2019 to buy the stock for $0.48… and sold it for $1.17 on Jan 11, 2021.

We made +143.75% in gains trading Draganfly on the public market.

That’s 13x higher than what any VC could give you!

And it only took 14 months (Not 10 years).

See what we did there?

Our strategy is to identify rising companies early… conduct our in-depth analysis before their IPO date and take our position shortly AFTER the companies are listed.

It’s much easier to sort the blockbusters from the bombs after the insiders sell their shares.

That’s how we kept our heads above the water while everybody else lost theirs.

Want another example?

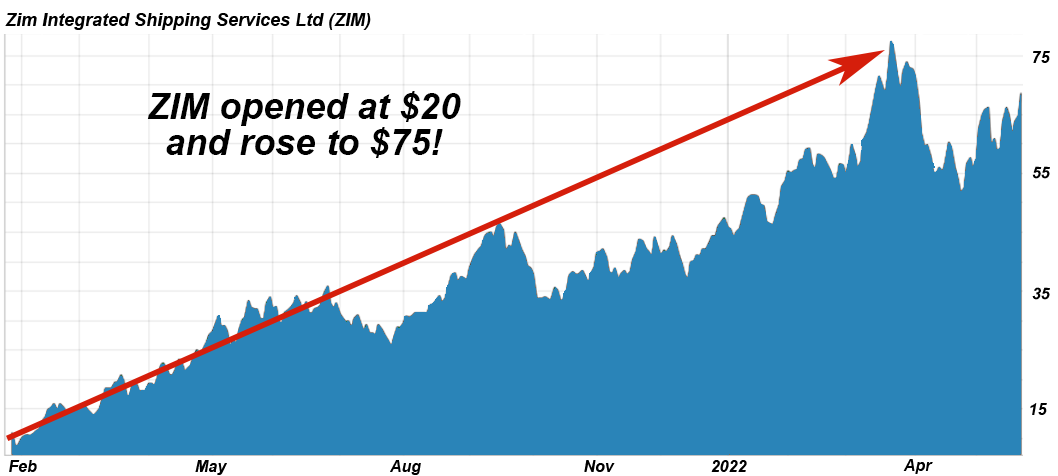

We knew early on that ZIM Integrated Shipping Services (ZIM) would be hot.

I’m talking way early… like six months in advance before the fat cats with money even saw it on their desk.

After a year of soaring freight costs, it’s just too obvious that we had to claim a piece of ZIM.

As one of the leading carriers in the global shipping industry, what sets ZIM apart is their ability to use technology to keep their vessel utilizations high and their costs low.

Shares debuted just under $20 in early 2021.

Look at how it skyrocketed…

What if you knew in advance this company would skyrocket shortly after its IPO day?

That’s what I can get you in IPO Edge.

In this case, you would’ve made an easy +275% in gains.

It’s all about being 10 steps ahead.

Now, we’ve been watching ZIM for a while now and we know that the best days are yet to come.

This company still has massive growth ahead of it.

I recommend ZIM as a company you can still get in on today (that’s a freebie for you).

I track deals like this every month.

And when the time is right, I tell my IPO Edge members to get in. It’s that simple.

I tell you what to look out for… what to buy… what to sell… and you can do-it-yourself with our easy-to-follow instructions.

Let me and my team do all the tedious work of managing a stellar portfolio and you can copy our “homework.”

Now, you get the benefit of a fully diversified IPO portfolio without paying any exorbitant fees.

In fact, your IPO portfolio will only get better and better as we add new hot IPO stocks in.

Take a look at some other exciting IPOs we’ve invested in…

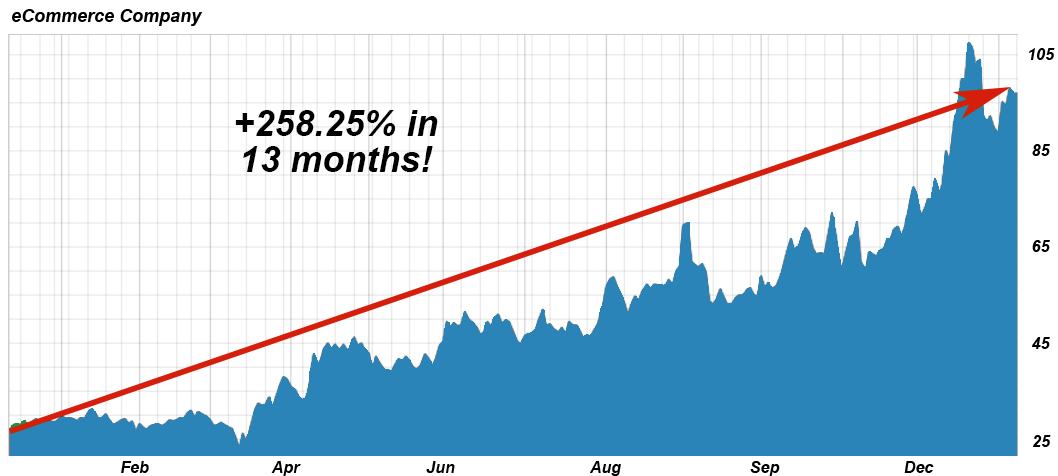

+258% Gains with Chewy (CHWY).

The IPO game is all about access, being ten steps ahead, and timing.

And remember, all these IPOs have years of growth ahead of them.

Doubling or tripling your money is just the beginning. Some of these IPOs we find could potentially go on to be five or even six-digit winners.

That’s how I “retired” at age 30. That’s how many of my clients and readers are millionaires. And because the IPO game is so much fun I’ve kept playing ever since.

Here’s Your Front Row Seat...

If You're Ready to Get A Piece Of The Action

We trade around 12 IPO stocks a year.

In one hot season alone, we traded multiple IPO stocks at a time.

We assembled our own “early stage” companies portfolio with tremendous growth ahead of them.

And then we kept adding fresh red-hot IPO stocks like we’ve hit the jackpot.

That’s how we accomplish triple digit performance like these even during the toughest slump in the IPO market.

| Ticker | Company | IPO Edge Return |

|---|---|---|

| TOP | Top Financial | 🠝 1026.52% |

| CHWY | Chewy | 🠝258.25% |

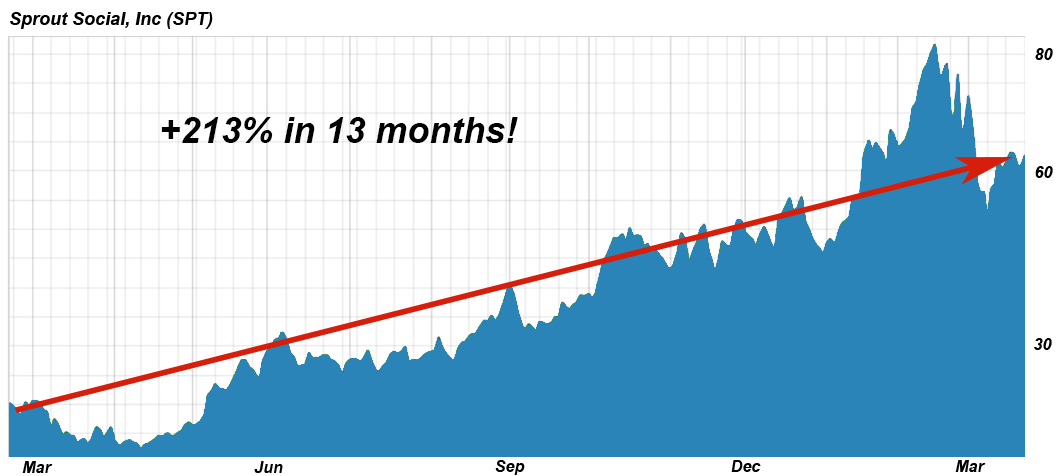

| SPT | Sprout Social | 🠝213.96% |

| PLTR | Palantir Technologies | 🠝181.69% |

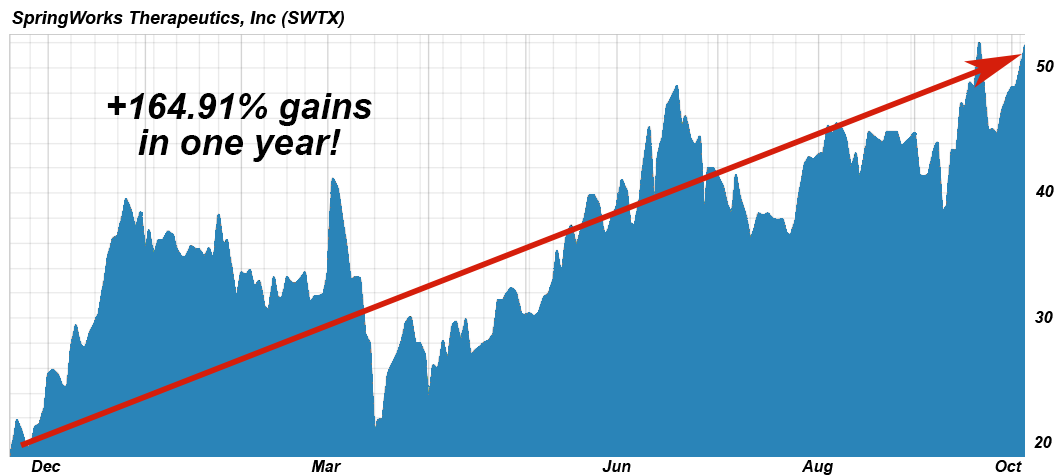

| SWTX | SpringWorks Therapeutics | 🠝164.99% |

| DPRO | Draganfly | 🠝143.75% |

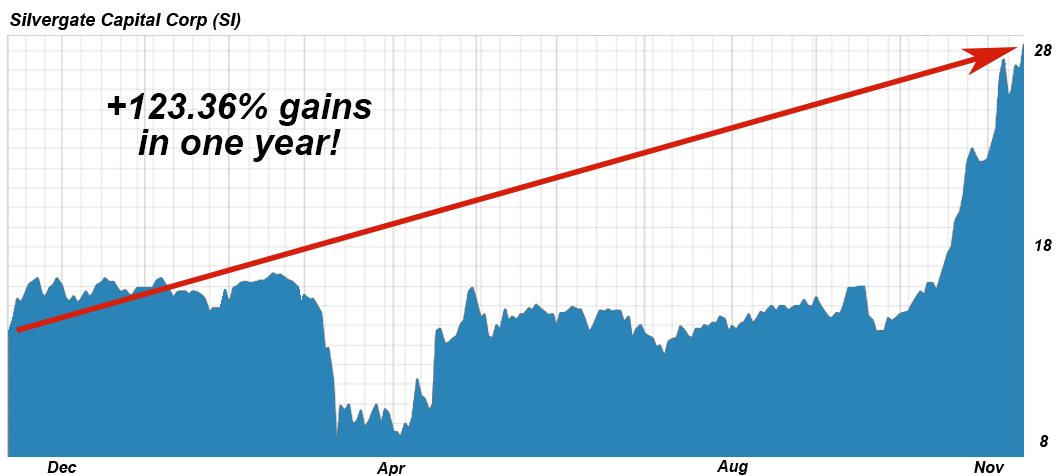

| SI | SI | 🠝123.36% |

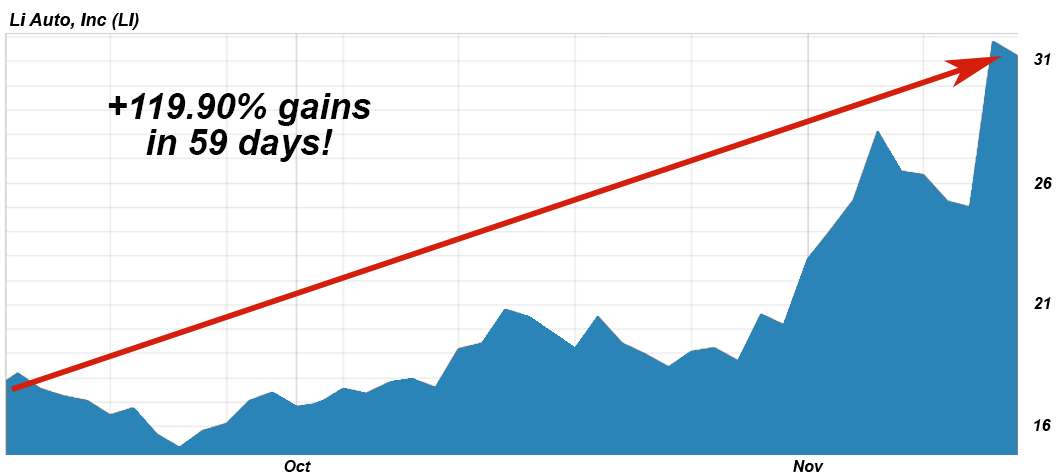

| LI | Li Auto | 🠝119.90% |

| ATLX | Atlas Lithium | 🠝 107.96% |

| KLDO | Kaleido Biosciences | 🠝 62.16% |

| MBLY | Mobileye | 🠝 55.49% |

| FSK | FS KKR Capital | 🠝 54.91% |

| ACLX | Arcellx | 🠝 53.11% |

With our recession-proof strategy, we get far more winners than non-performers in our portfolio.

In fact, we constantly bring in fresh new rising stars and remove non-performers to keep our portfolio strong and healthy.

Each month you can look out for two features in our IPO Edge service.

You get one early-stage company profile to look out for.

This is exclusive only for IPO Edge subscribers.

No one else gets in this early on a rising star.

You also get an IPO that got listed fresh out of the gate.

These are definitely the ones we’re watching like a hawk to take a position.

We’ll alert you when it’s time to buy and time to exit.

Plus… we’ll constantly inform you of the changes we make to the IPO portfolio so you can copy it.

This alone maximizes the money you make from IPOs.

Our goal is to stay as close to the initial offering as possible… buying within the first year and holding on for no more than a year.

All this while we’re keeping a close eye on any new opportunities that the market ignores so we get the maximum gain in the shortest possible time.

No one else outside these circles would be any wiser. They’ll be too distracted with what’s going on to even notice that the locked vaults to great wealth is now wide open. We have zero competition right now and we must move quick!

Real Results From Our IPO Edge Subscribers

Palantir (already) went up +175% for me!

On your IPO Edge service, I bought PLTR which is up 175% for me.

– Ed G., Washington State

I purchased Neo at $4.50 and sold over $45 (+1,000%)!

I have invested for years, but am relatively new to active trading and searched for a source of authentic knowledge and information on the trades to do. There are a lot of fake gurus on the internet, but Hilary Kramer is the real deal. More than just trading I’ve learned how markets function, how to better understand the day’s news, and to manage my risk better. On her recommendations, I looked into the EV sector and made trades with 40-100% profit. I purchased Neo at $4.50 and sold over $45 (+1,000%), LI at $20 and sold at $30 (+150%), and FSR at $11 and sold at $20.37 (+185%), just to name a few.

– Paul S., Cambridge, MA

SpringWorks at $19 (272%). Silvergate Capital at $11 (+253%). Draganfly at $0.48 (+143%)

I’m eager to see where they are in five years. On the other hand, some of the sells have been good exits. I think she does a good job getting us out at the best time and definitely excels at finding new stocks the market just doesn’t appreciate yet.

– Karl, Sarasota, FL

These are just a handful of the stories I hear from our subscribers. There’s more.

One stay-at-home mom used her profits to take a long family vacation…

Another gentleman now owns and and sails his own dream boat…

One teacher even donated her profits to her favorite charity…

That story can be yours too.

Once you get your first taste of success, you can keep using IPO Edge to help you achieve your financial goals.

It’s very simple.

You get to watch over my shoulder and collect your cut of the profits like…

+123% Gains with Silvergate Capital (SI).

Only Because You’re Already Here -

I Got A Special Deal For you

Exclusive IPO Edge Research Reports. You’ll get access to “hot-off-the-press” insights on undiscovered, early-stage companies to look out for. When you sign up today, you’ll get immediate access to three just-released research reports: 1) The IPO Edge Playbook with all the details on how the service works, what makes it unique and how you can get started right away. 2) Former “Unicorn” IPOs to Avoid, which details 10 luminaries turned losers. 3) New Names, Compound Gains that shares the details on 10 IPOs that are doing things right. These three research reports are yours FREE when you join today.

Truthfully, the best part about the IPO Edge service is that your portfolio continues to generate returns year after year.

That’s how the rich get richer!

The amount of money you could make with this premium service alone is staggering.

Go ahead and sign up now before the 72 hours are up. My team will onboard you right away so you can begin your journey immediately. Remember, we have to get in early to win big in the IPO game.

I promise this will be the most exciting – and profitable – time of your life.

Again, click here to join or call (877) 440-8224 to speak to a member of our Customer Service Department to help you get started with IPO Edge at today’s special price.

Sincerely,

Hilary Kramer

CEO

Greentech Research

P.S. Timing is everything. Once we sell our position and collect our checks, we’re moving on to the next. You must get on board right away to participate.

P.P.S. Don’t forget, this special price is only available for the next 72 hours.

P.P.P.S. If you are still on the fence, look at what Paul S. from Cambridge, Massachusetts had to say about the IPO Edge. “On Hilary’s recommendations, I looked into the EV sector and made trades with 40-100% profit. I purchased Neo at $4.50 and sold over $45 (+1,000%), LI at $20 and sold at $30 (+150%), and FSR at $11 and sold at $20.37 (+185%), just to name a few.” Now it’s your turn.

Welcome to the IPO Winners Circle!

...available for the next 72 hours only

I can confidently say, when you join our IPO winners circle, you can make huge gains this year.

You’ll never have to guess when to buy… when to sell… when to switch, and when to double down.

I guarantee that you won’t find anything like this elsewhere. No one else can top our track record. Even if they could, they’re not telling you how it’s done.

It takes a lot of work and we’ve done it all for you…

We search high and low for the best early-stage companies with tremendous growth ahead of them.

We vet the companies… analyze their businesses… interrogate their management teams… until it’s clear that we have a champion.

We constantly monitor our IPO stocks, which helps us identify the perfect time to buy… to sell… and when it’s time to switch over to a new winner.

Built-in diversification and portfolio management with no sneaky fees.

We even thrived during the decade’s most bearish market conditions and delivered above-average results!

| Ticker | Company | IPO Edge Return |

|---|---|---|

| TOP | Top Financial | 🠝 1026.52% |

| CHWY | Chewy | 🠝258.25% |

| SPT | Sprout Social | 🠝213.96% |

| PLTR | Palantir Technologies | 🠝181.69% |

| SWTX | SpringWorks Therapeutics | 🠝164.99% |

| DPRO | Draganfly | 🠝143.75% |

| SI | SI | 🠝123.36% |

| LI | Li Auto | 🠝119.90% |

| ATLX | Atlas Lithium | 🠝 107.96% |

| KLDO | Kaleido Biosciences | 🠝 62.16% |

| MBLY | Mobileye | 🠝 55.49% |

| FSK | FS KKR Capital | 🠝 54.91% |

| ACLX | Arcellx | 🠝 53.11% |

IPOs are giving investors a once-in-a-decade opportunity to build life-changing wealth.

I don’t want you to be left on the sidelines. That’s why for the next 72 HOURS ONLY, I’ve decided to let you try IPO Edge for a year for only $995.

If you’re not ready to commit to a full year of IPO Edge, I’ve made it possible for you to try it for 30 days for just $99.

But you must act fast.

Simply Fill Out the Form Below

or Call (877) 440-8224 to Start Immediately

Please Note: If you already subscribe to one of Hilary Kramer’s services, click here to log in first, and then you’ll be able to complete your order. You only need to do this one time.

Order Summary

Already have an account? Click here to login

If you already have an account on this site, please login below. Otherwise, please proceed to the Details section.

- Your Order: IPO Edge (4-Wk) Sale Price

- Subscription Length: 4 weeks

- Recurring: Yes

- Content Access: Unlimited IPO Edge

Total: $99